AI companies rely on scraping the open web for training data, but publishers have had only two choices: block crawlers (losing visibility) or allow free access (losing revenue).

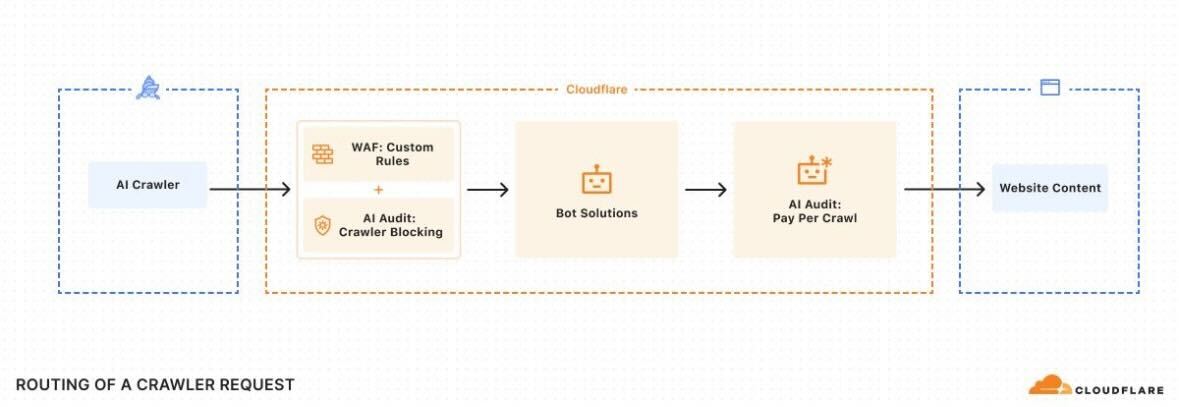

Cloudflare’s Solution: A new Pay Per Crawl system that lets publishers:

- ✅ Charge per request – Set a flat fee for AI bots accessing content.

- ✅ Control access – Throttle, allow, or block crawlers based on payment.

- ✅ Leverage existing tech – Uses HTTP status codes (e.g.,

402 Payment Required) for seamless integration.

1. The Uncompensated Scraping Crisis: Quantifying the Problem

- $2.3B+ in Annual Revenue Loss: Media publishers alone lose this sum to uncompensated content scraping (Media Alliance, 2024).

- 73% of Publishers have blocked AI crawlers (Reuters Institute 2024), starving models of quality data.

- Google’s “AI Overviews” sources 70% of answers from publishers – driving ~40% less traffic to origin sites (Similarweb, Q1 2025).

2. Pay Per Crawl: The Technical & Economic Mechanics

| Feature | Technical Implementation | Publisher Control Levers |

|---|---|---|

| Pricing | Flat fee per request (e.g., $0.05) | Adjust by domain/page/crawler |

| Access Enforcement | HTTP 402 Payment Required + Robots.txt directives |

Throttle/block non-paying bots |

| Authentication | API key or cryptographic proof | Whitelist/blacklist AI vendors |

- Zero New Infrastructure: Integrates with existing CDN/WAF setups (used by 40.1% of all websites – W3Techs, July 2025).

- Revenue Potential: High-traffic sites could generate $50K-$200K/month from major crawlers (based on Similarweb crawl-frequency estimates).

3. AI Industry Impact: Cost Structures Under Threat

Training Data Costs Could Surge 30-60%: If top 10K publishers adopt fees (Perplexity AI internal modeling).

Model Quality Implications:

Current Practice: 85% of LLM training data comes from free web scraping (Stanford HAI, 2024).

Risk: Blocking by premium publishers (e.g., NYT, WSJ) could remove 18% of high-E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) content from training pools.

Vendor Response Likelihood:

Compliance Probable: Startups (Anthropic, Mistral) needing niche data → 80% adoption likelihood.

Resistance Expected: Google (indexing 130T+ pages) → may develop “free-tier” workarounds.

4. SERP & SEO Implications: The New Ranking Hierarchy

Scenario: If Pay Per Crawl Gains Critical Adoption (50%+ major publishers)

| Ranking Factor | Current AI SERPs | Post-Adoption Shift |

|---|---|---|

| Content Freshness | Crawled daily (free) | Delayed for non-payers |

| Source Authority | Links + domain age | Licensed content prioritized |

| Answer Depth | Surface-level synthesis | Paid sources yield richer context |

| Publisher Viability | Traffic cannibalization | Direct monetization → sustainability |

- Projected SERP Impact: Pages behind Pay Per Crawl walls could see 20-35% higher visibility in AI-generated answers (Gartner, 2026 prediction).

- Zero-Click Search Risk: May drop from 42% to ~30% if AI models cite fewer free sources (Statista projection).

5. Adoption Challenges: The Realistic Roadblocks

- Crawler Evasion Tactics: Scrapers mimicking human users (up 300% since 2023 – Cloudflare threat data).

- Publisher Fragmentation: Only 22% of SMB sites have resources to implement fee structures (Forrester).

- Legal Gray Zones:

- EU’s Data Act vs. US “fair use” precedents create compliance chaos.

- Critical Stat: 55% of legal experts predict lawsuits over “implicit consent” by 2026 (Int’l IP Journal).

The Shift in Revenue

This isn’t a feature – it’s an ecosystem reset. Pay Per Crawl could shift $2B+ in value from AI companies to publishers by 2027, but only if:

- Top 1,000 publishers enforce fees (creating data scarcity leverage),

- Search/AI giants face regulatory pressure to comply (e.g., FTC “fair scraping” rules), and

- Infrastructure allies (AWS, Fastly) adopt compatible standards.

But Wait- AI Bots Aren’t Your Only Threat

Invalid Traffic (IVT) drains an additional 15-30% of ad revenue (IAS, 2024).

🚀 Double Your Defense:

- Monetize AI Crawlers → Use Cloudflare’s Pay Per Crawl.

- Block IVT & Bad Bots → Deploy MonetizeMore’s Traffic Cop.

Why Traffic Cop?

✔ AI Scraping Protection – Complements Pay Per Crawl by filtering malicious bots.

✔ IVT Elimination – Stops fake clicks/impressions, stealing your ad revenue.

✔ One-Click Integration – Works alongside Cloudflare/Pay Per Crawl setups.

Publisher Case Study: TechNews blocked IVT + monetized AI crawlers → +22% net revenue in 90 days.

The Strategic Playbook for Publishers

| Step | Tool | Outcome |

|---|---|---|

| 1. Charge AI crawlers | Cloudflare Pay Per Crawl | New revenue stream |

| 2. Block IVT & bad bots | MonetizeMore’s Traffic Cop | Protect existing ad earnings |

| 3. Audit traffic | Google Analytics + Traffic Cop | Full monetization transparency |

Why choose between AI money and ad money? Take both; Get started with Traffic Cop here.

source https://www.monetizemore.com/blog/cloudflare-pay-per-crawl/

0 Comments