Ad rates have been falling because of multiple pressures. Competition among publishers has exploded, with over 600 million blogs active globally. Economic uncertainty has forced advertisers to cut budgets, slowing global ad spend growth to just 4-6 percent in 2025. Programmatic buying has led to a surplus of ad inventory, and privacy regulations such as GDPR and the phase-out of third-party cookies in Chrome have reduced targeting precision. Together, these factors push CPMs downward.

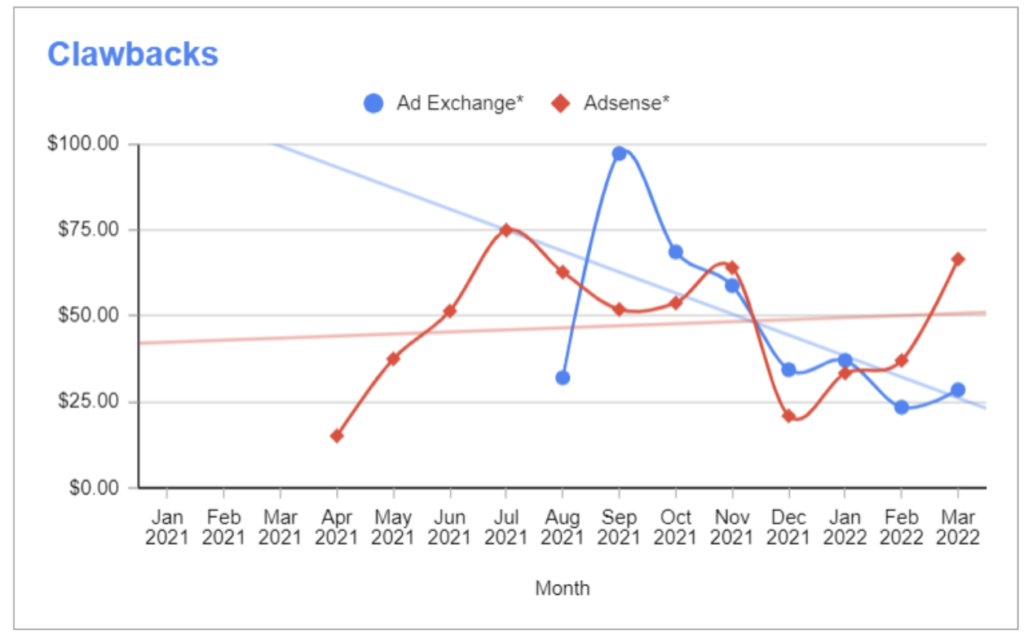

Publishers have seen notable revenue declines. Mid-tier publishers report CPM drops of 15 to 25 percent year-over-year. Video CPMs fell by as much as 18 percent in Q4 of last year, for smaller publishers heavily dependent on display ads, revenue contractions of 30 percent or more are common.

Biggest drivers of falling CPMs

Several forces are responsible for falling ad rates:

- Content congestion: Too many publishers chasing the same audiences.

- Ad inventory surplus: More supply than advertiser demand.

- Global inflation and budget tightening.

- Privacy-first advertising: Less data for precise targeting.

- Poor user experience: Sites with intrusive ads or low-quality content attract fewer premium buyers.

The barrier to entry for online publishing (Thanks to ChatGPT:P) has significantly diminished, allowing a larger number of content creators to establish their digital presence. With the advent of user-friendly website builders, content management systems, and social media platforms, individuals and organizations can easily create and distribute their content. As a result, the sheer volume of publishers has soared, creating a crowded and highly competitive environment.

The congestion in online publishing is amplified by the availability of vast amounts of content across various niches. As publishers compete for visibility and engagement, the audience’s attention becomes increasingly fragmented. This fragmentation makes it challenging for advertisers to reach their desired audience effectively, thereby diminishing the value of ad placements and leading to lower ad rates.

How user experience affects ad rates?

Good user experience directly translates into higher CPMs. Publishers with sites loading under 2.5 seconds earn up to 35 percent more than slower ones. Ads that are non-intrusive and engaging boost user trust and generate higher engagement rates. Advertisers prefer publishers with strong UX reputations and are more willing to pay for quality inventory.

Bad user experience, however, has the opposite effect. Heavy ad clutter, pop-ups, autoplay videos with sound, or slow-loading pages frustrate users. Research shows that over 42 percent of users install ad blockers because of poor ad experiences. High bounce rates, low dwell times, and ad-blocker penetration all signal to advertisers that inventory is less valuable. In such cases, CPMs drop and advertisers may even blacklist domains that consistently deliver negative UX.

In short, great UX boosts trust, engagement, and ad revenue, while bad UX erodes user loyalty and pushes CPMs down. Publishers who invest in site speed, ad quality, and balanced design are far more likely to secure premium advertiser demand.

With more inflation comes reduced ad budgets

Ad budgets have experienced a drop due to ongoing global economic uncertainty. In times of economic instability, businesses often exercise caution and tighten their financial belts, leading to reduced advertising expenditures.

The current global economic uncertainty can affect consumer spending patterns. When consumers become more cautious about their purchases, businesses may perceive a reduced return on investment from advertising. As a result, they may allocate fewer funds to advertising initiatives to align with the diminished consumer demand.

Moreover, the evolving business landscape and the emergence of new marketing channels and strategies have further impacted advertising budgets. Digital advertising platforms, for instance, offer more cost-effective options, enabling companies to allocate funds to targeted online campaigns at the expense of traditional advertising channels. This shift in advertising priorities can lead to a redistribution of budgets, causing a decline in ad rates across various publishing platforms.

As ad inventory quantity goes up, the ad rates go down. More ads don’t mean more revenue.

As ad inventory expands, rates typically fall because supply begins to outpace advertiser demand. For example, Connected TV platforms have seen CPMs drop from more than $54 in 2023 to around $31 projected by 2025 as ad-supported content surges. Reports also show fill rates falling by 18 percent year-over-year, meaning many new ad slots go unsold or are filled at lower prices. This illustrates the simple truth that more ads do not always equal more revenue; in fact, oversupply often erodes yield and depresses CPMs

Are privacy Regulations hitting hard on Ad Rates?

Privacy laws restrict user-level data collection. With third-party cookies disappearing, advertisers are turning to contextual targeting, which is less efficient. Publishers that build first-party data strategies, such as subscription logins or surveys, see CPM uplifts of 20 to 40 percent. Transparency and compliance not only build trust but also preserve advertiser spend.

As a result, advertisers now face limitations on collecting, using, and sharing user data for targeting purposes. Previously, advertisers could leverage detailed user profiles and behavioral data to deliver highly personalized and targeted ads. However, with the implementation of stricter data protection laws, advertisers must navigate a more privacy-conscious landscape that imposes restrictions on data usage and sharing.

These targeting limitations have implications for ad rates. Advertisers may no longer have access to the same level of granular targeting options they once enjoyed. The ability to deliver highly tailored ads to specific audiences may be curtailed, making it more challenging to achieve the desired reach and effectiveness. Consequently, advertisers may be less willing to pay premium rates for ad placements that offer limited targeting capabilities.

Publishers need to be aware of these shifting privacy practices and regulations to adapt their advertising strategies accordingly. They may need to explore alternative approaches to ad targeting, such as contextual advertising that relies on the webpage’s content rather than user-specific data. Publishers who prioritize transparency, consent management, and compliance with privacy regulations can build trust with users and advertisers, potentially mitigating the impact on ad rates.

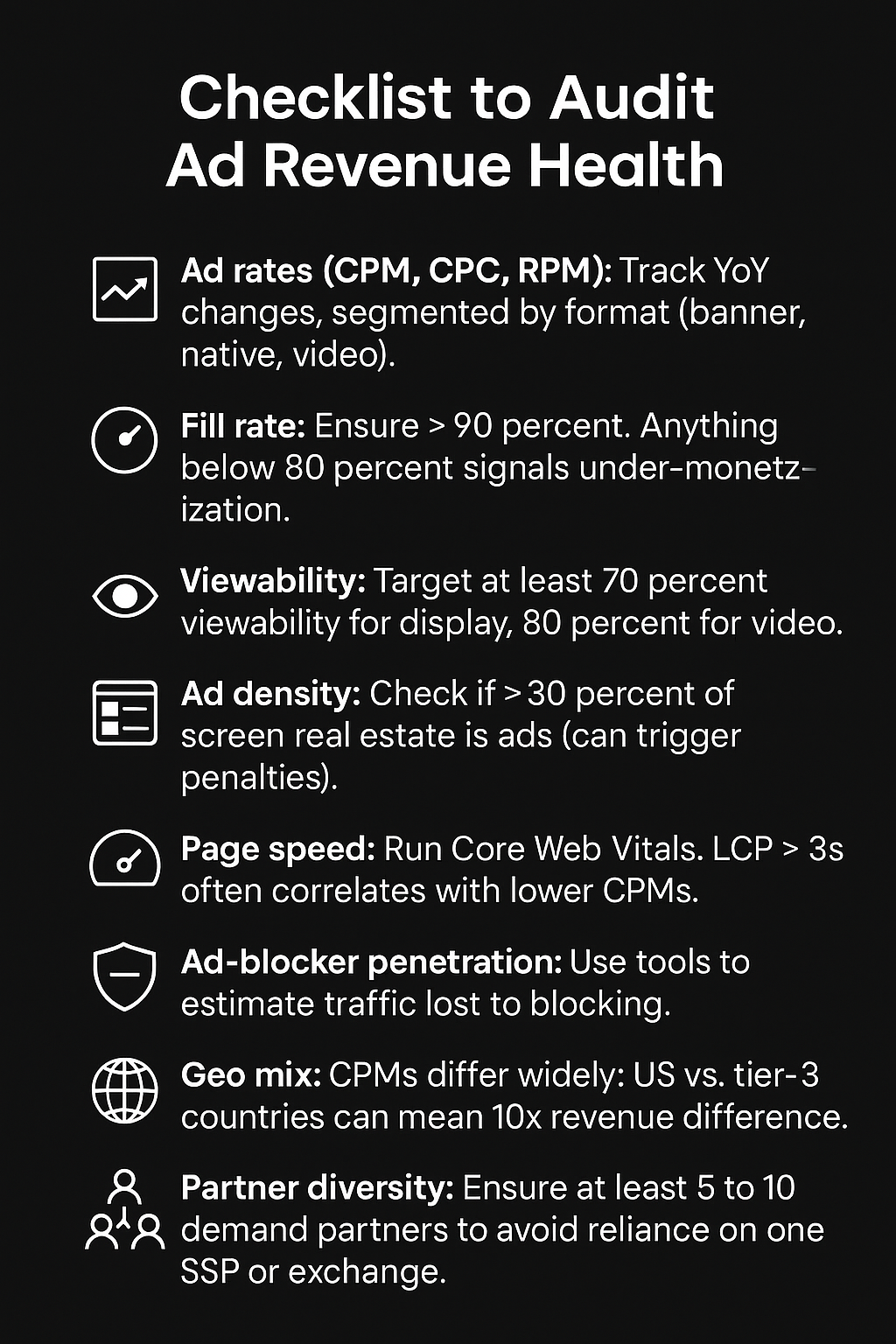

Here’s a Checklist to Audit Ad Revenue Health

The first step is to run a full ad revenue audit. Next, experiment with new ad formats that enhance user experience. Finally, collaborate with an adtech partner to expand demand and implement advanced optimization strategies. These actions help stabilize CPMs and unlock growth in a challenging market.

- Ad rates (CPM, CPC, RPM): Track YoY changes, segmented by format (banner, native, video).

- Fill rate: Ensure >90 percent. Anything below 80 percent signals under-monetization.

- Viewability: Target at least 70 percent viewability for display, 80 percent for video.

- Ad density: Check if >30 percent of screen real estate is ads (can trigger penalties).

- Page speed: Run Core Web Vitals. LCP > 3s often correlates with lower CPMs.

- Ad-blocker penetration: Use tools to estimate traffic lost to blocking.

- Geo mix: CPMs differ widely; US vs. tier-3 countries can mean 10x revenue difference.

- Partner diversity: Ensure at least 5 to 10 demand partners to avoid reliance on one SSP or exchange.

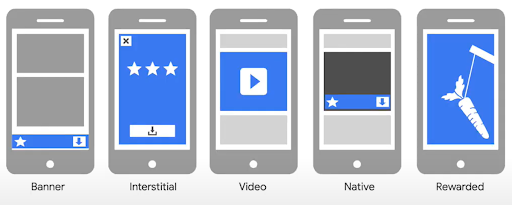

Are new ad formats the solution?

Yes. Innovative formats attract premium buyers:

- Video ads deliver engagement rates up to 5x higher than banners.

- Interactive ads increase conversion intent by 47 percent compared to static display.

- Parallax and immersive ads command CPMs 2 to 3 times higher than traditional formats.

How can MonetizeMore help publishers adapt?

Working with an adtech partner adds significant advantages. MonetizeMore provides header bidding solutions, advanced ad quality filters, and revenue dashboards. Their teams guide publishers toward better ad optimization and help diversify monetization beyond display. Established relationships with advertisers also bring premium demand that independent publishers often cannot access.

Additionally, adtech partners can assist publishers in navigating the complexities of programmatic advertising and automation. They can provide access to programmatic ad exchanges, demand-side platforms, and supply-side platforms, enabling publishers to reach a wider range of advertisers and effectively monetize their ad inventory.

While publishers can certainly take steps to address low ad rates and explore alternative revenue streams, the expertise, technology, and industry connections an adtech partner brings can significantly enhance their efforts. Collaborating with an adtech partner can help publishers navigate the dynamic ad landscape more effectively and unlock additional opportunities for revenue growth.

| Benefits with an Adtech Partner like MonetizeMore | Challenges without them | |

|---|---|---|

| User Engagement | Access to expertise in optimizing user engagement strategies and best practices. | Lack of specialized knowledge and resources to effectively enhance user engagement. |

| Site Speed | Assistance in optimizing site speed for improved user experience. | Difficulty in identifying and implementing site speed improvements without specialized support. |

| Ad Optimization | Expertise and tools for ad optimization, maximizing ad revenue. | Limited ability to optimize ad placements and formats effectively without access to adtech solutions. |

| Alternative Revenue Streams | Guidance on exploring and implementing alternative revenue streams like native advertising or sponsored content. | Lack of industry connections and expertise to effectively diversify revenue streams. |

| Industry Insights | Access to industry trends, market insights, and evolving technologies. | Missed opportunities to stay updated on the latest developments and best practices in the adtech industry. |

| Relationships and Partnerships | Established connections with top advertisers, agencies, and ad networks, providing access to more lucrative ad opportunities. | Difficulty in establishing direct partnerships and accessing premium advertising opportunities independently. |

By partnering with an adtech company like MonetizeMore, publishers can leverage the expertise, resources, and industry relationships an adtech partner brings, enabling them to overcome challenges and unlock the benefits discussed above.

Split test with new ad formats to attract higher-paying advertisers and 10X ad rates.

Yes, experimenting with new ad formats like parallax, video, and interactive ads can attract higher-paying advertisers and potentially increase ad rates for publishers.

New and innovative ad formats have the potential to capture users’ attention, provide an engaging experience, and deliver brand messages more effectively. Advertisers are constantly seeking ways to stand out and connect with their target audience, and these new formats offer unique opportunities to achieve that.

Parallax ads, for example, create a sense of depth and movement, allowing for more visually captivating experiences. Video ads have proven to be highly engaging and can convey messages in a dynamic and immersive manner. Interactive ads enable users to interact with the content, increasing their involvement and creating a memorable experience.

By incorporating appealing ad formats into their offerings, publishers can differentiate themselves in the market and attract advertisers who are looking for innovative ways to engage their audience. Higher-paying advertisers are often willing to invest in these formats as they can yield better results in terms of brand exposure, user interaction, and conversion rates.

Advertisers value unique and captivating ad experiences and are often willing to pay more for placements that offer such opportunities. As a result, by offering these new ad formats, publishers can position themselves as providers of high-value ad inventory and negotiate better rates with advertisers.

One of our streaming site publishers lifted video RPMs by 30 percent through better UX and rewarded ad formats.

So, what are you waiting for? Get back on the ad-optimization success path by getting started with us here!

Related Reads

https://www.monetizemore.com/blog/ad-revenue-forecast/

https://www.monetizemore.com/blog/mediavine-vs-adsense-vs-monetizemore-ad-revenue/

https://www.monetizemore.com/blog/what-are-the-highest-earning-ad-sizes/

https://www.monetizemore.com/blog/how-to-secure-5x-more-ad-revenue/

source https://www.monetizemore.com/blog/my-ad-rates-dropped-how-do-i-stop-this/

0 Comments