The programmatic advertising industry is currently navigating a complex landscape as it emerges from the AdOps Recession. After experiencing a significant downturn in 2024, marked by ad revenue plummeting to its lowest levels in five years, there are signs of recovery on the horizon. Despite the challenges posed by inflation and changing consumer behavior, forecasts for 2025 indicate a rebound in ad spending, driven by a more optimistic economic outlook and strategic shifts in advertising approaches. In 2025, global advertising revenue is projected to surpass $1 trillion for the first time, with an expected growth of 7.7%, reaching approximately $1.1 trillion. This growth is largely attributed to the continued rise of digital advertising channels, including retail media and streaming services, which are becoming increasingly vital for brands looking to connect with consumers effectively. Streaming ad revenue alone is anticipated to grow by 19.3%, reflecting the ongoing shift towards digital consumption.

Regional Insights:

- United Kingdom: The UK is expected to see a 7.0% increase in advertising revenue, reaching £42.5 billion in 2025, buoyed by an improved economic forecast

- Australia: The Australian market is projected to grow by 3.8%, aided by upcoming federal elections that will inject additional spending into political advertising.

- India: India’s ad revenue is forecasted to grow by 9.5%, following a robust performance in 2024, driven by the expansion of digital platforms and increased consumer engagement.

- U.S.: The U.S. advertising market is projected to grow by 6.3% in 2025, driven by strong investments in digital and streaming platforms. This growth is fueled by resilient consumer spending and a shift toward data-driven advertising strategies.

- Europe: In the EU, advertising revenue growth is forecasted at 5.0% for 2025, with digital channels leading the charge. Digital advertising will account for a substantial portion of total ad spend, with retail media expected to grow rapidly as brands leverage consumer data for targeted campaigns.

Main Growth Drivers:

Digital advertising continues to dominate the landscape, accounting for a significant share of total ad spend. Pure-play digital advertising is expected to grow by 12.4% globally in 2025.

Media companies focusing on live sports and events are likely to see stabilized or increased ad revenues as advertisers prioritize these high-engagement opportunities. The rise of algorithmically driven ad strategies is reshaping media investments, allowing for more targeted and efficient ad spending.

As businesses adapt to these pressures, they are increasingly turning towards innovative solutions such as generative AI and personalized marketing strategies to enhance engagement and drive sales.

AdTech Industry Outlook

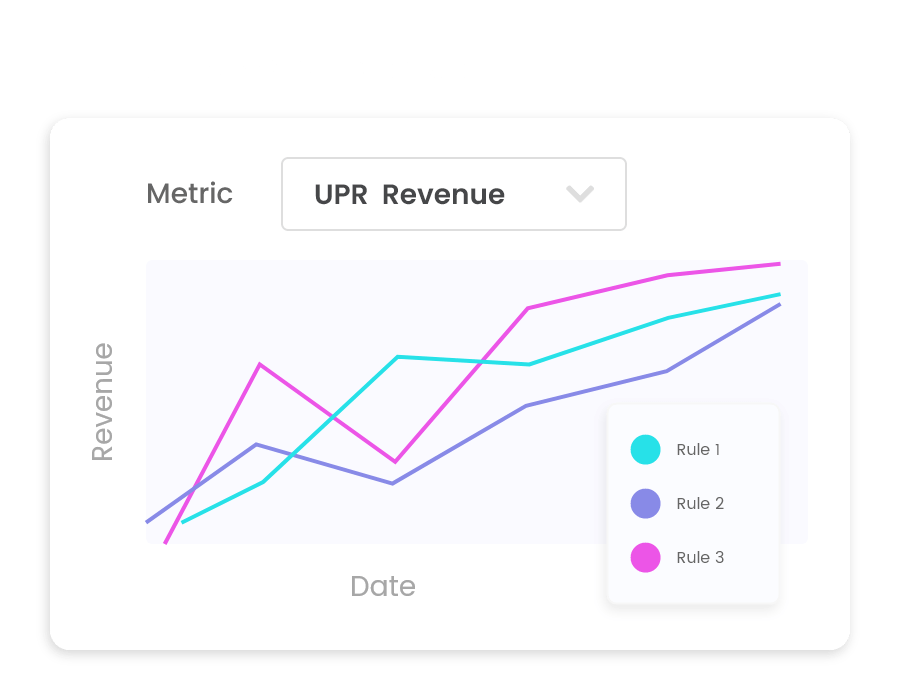

Programmatic advertising is set to continue its upward trajectory, with expectations that global programmatic spend will reach approximately $725 billion by 2026. Publishers should optimize their ad placements through automated bidding strategies that target the right audience at the right time, maximizing revenue potential.

Contextual advertising is making a comeback as a powerful tool for connecting ads with relevant content. Publishers with diverse content libraries can offer high-impact contextual solutions, allowing advertisers to reach their target audiences more effectively without relying heavily on personal data.

The rise of video content, particularly through Connected TV (CTV), presents a lucrative opportunity for publishers. By enhancing video offerings and aligning with evolving advertiser preferences, publishers can tap into this growing market segment, which is expected to see significant investment in 2025.

Gamified advertising is emerging as an innovative way to engage audiences and enhance interaction. By incorporating interactive elements into ads, publishers can boost audience engagement while delivering measurable value to advertisers.

The trend of shoppable content is gaining momentum, allowing publishers to turn editorial features into seamless shopping experiences. This not only diversifies revenue streams but also enhances user engagement by providing a direct path from content consumption to purchase.

In the second half of 2025, AdOps experts expect ad revenue numbers to go back up

Industry experts believe that there’s hope on the horizon, with a resurgence in ad revenue expected to come from the third quarter.

As businesses start adjusting to inflation, they will start to increase their advertising budgets, leading to an increase in ad spend. This, in turn, will result in more ad revenue for publishers.

Over-the-top (OTT) advertising is another area that is expected to grow in Q2.

As more and more people consume video content online, OTT advertising will become an increasingly attractive option for brands looking to reach their target audiences.

This is good news for publishers, as it will provide them with new opportunities to monetize their video content.

The demand for native advertising is also expected to increase in the second half. Native advertising is a form of advertising that is designed to blend seamlessly with the surrounding content, making it less intrusive and more effective.

As more brands realize the benefits of native advertising, they will start to allocate more of their budgets to this type of advertising, leading to an increase in ad revenue for publishers.

The emergence of new advertising platforms and technologies such as Virtual and Augmented Reality will also play a role in ad revenue recovery. Brands will start experimenting with these technologies in their ad campaigns, which will result in more ad revenue for the publishers.

Personalized advertising is another trend that is expected to drive ad revenue recovery later this year. As consumers become more and more accustomed to seeing personalized ads, they will start to respond more positively to them, leading to an increase in ad revenue for publishers.

Transparency and brand safety will become even more important by Q2. Brands will be more vigilant about where their ads are placed and will want to ensure that their ads are not associated with any controversial or unsafe content. This will lead to an increase in ad revenue for publishers that can demonstrate a commitment to transparency and brand safety.

Finally, audio and voice advertising are expected to grow in popularity by Q3. As more and more people adopt smart speakers and other voice-enabled devices, audio and voice advertising will become an increasingly attractive option for brands looking to reach their target audiences. This will provide new opportunities for publishers to monetize their audio content, leading to an increase in ad revenue.

What to do, then?

In conclusion, while the current situation may be challenging for publishers, it is important to remember that MonetizeMore is here to save you regardless of inflation or recession.

Regardless of the type of ad monetization solution or demand source you use, get ready for a tough first half of 2025. You are not the only business that is getting affected here.

Your revenue will be rollin’ back up as long as we have your back. If you aren’t already with us, then sign up here.

source https://www.monetizemore.com/blog/ad-revenue-forecast/

0 Comments